English

- 首頁

- /

- English

Gold-In is a distinguished professional firm with a rich legacy spanning more than 25 years. Gold-In is a member of Kreston International since 2002. Gold-In is committed to excellence, leveraging our extensive expertise. We specialize in facilitating and assisting foreign investments in Taiwan. Gold-In is dedicated to providing comprehensive support to clients:

- Company registration, including the establishment of subsidiaries, branches, and representative offices;

- Payroll Outsourcing; and;

- Global mobility and expatriate income tax; and

- Other tax and management consulting services in Taiwan.

Know about Taiwan

For over five decades, Taiwan has undergone a remarkable transformation; earning global recognition as an “economic miracle” and standing proudly among the “Four Asian Tigers.” The prevailing image of poverty and material deprivation has been relegated to the past, replaced by a dynamic and flourishing economy. This achievement is the result of meticulous economic development plans implemented by the government, coupled with the relentless dedication of a highly skilled and industrious labor force. Furthermore, the driving force behind Taiwan’s economic success lies in its vibrant and ambitious entrepreneurial spirit that permeates the nation, propelling its economy to unprecedented heights.

The privilege of investing in Taiwan

Investing in Taiwan comes with a range of privileges, making it an attractive destination for investors:

- Strategic Location: The nation’s strategic location in the Asia-Pacific region serves as a gateway to lucrative markets, offering investors a strategic advantage in accessing and serving diverse international markets.

- Global Competitiveness: Taiwan’s competitive advantage in international trade and its active participation in global economic networks offer investors the privilege of being part of a globally interconnected and competitive business ecosystem.

- Robust Economic Environment: Taiwan’s dynamic and resilient economy, coupled with consistent GDP growth, provides investors with a stable and promising investment climate.

- Pro-Business Policies: The government’s proactive measures and policies aimed at fostering a business-friendly environment, creating a privileged space for investors, ensuring transparency, ease of doing business, and a supportive regulatory framework.

- Taxation Advantage:The corporate income tax and value-added tax in Taiwan are notably favorable for investors, with maximum rates capped at 20% and 5%, respectively. These rates stand out as significantly lower than those in many advanced countries, providing an appealing fiscal environment for businesses.

- Incentive Framework:To sustain a conducive atmosphere for diverse overseas investments, the Taiwanese Government implemented the “Statute for Upgrading Industries” in 1990. This statute is designed to advance overall economic development by promoting investments in emerging industries, fostering the introduction of new technologies, and addressing challenges related to industrial land access. This initiative underscores the government’s commitment to fostering a business-friendly environment and encouraging innovation in the industrial landscape.

Investors stand to benefit from these incentives, which collectively make Taiwan an ideal destination for those seeking sustainable growth and success in the global marketplace.

Whether operating a subsidiary or a branch, entities are bound by the stipulations of the “Taiwan Business Accounting Law,” governed by the following principles:

- Adherence to Taiwan Accounting Standards: Accounting accounts must conform to the established Taiwan Accounting Standards.

- Language of Accounts: Accounts are to be prepared and maintained in Chinese. If the accounts are prepared in a language other than Chinese, a Chinese-translated version must be promptly provided upon request by the tax administration authority.

- Currency Usage: The Taiwan dollar serves as the official accounting currency.

- Annual Corporate Income Tax Return: Entities are required to file an annual corporate income tax return.

- Bi-Monthly Business Tax Returns: Submission of business tax returns is mandatory every two months.

- Withholding Tax on Payments to Foreign Entities: Payments to foreign entities are subject to withholding tax.

- Compliance with Withholding Requirements: Withholding and payment must align with legal requirements.

Moreover, it’s important to note that offices, distinct from subsidiaries and branches, cannot engage in profit-making activities, alleviating any associated tax burden concerns. This differentiation underscores the regulatory framework, ensuring compliance with tax laws and promoting transparency in financial practices.

Note 1. If the business entity engages in activities that require a special permit or approval, the authorities may set a higher capital requirement

*Rate based on 2023 Tax Rate Issued

Company Registration Services

- Setting up a subsidiary

- Setting up a branch of a foreign company

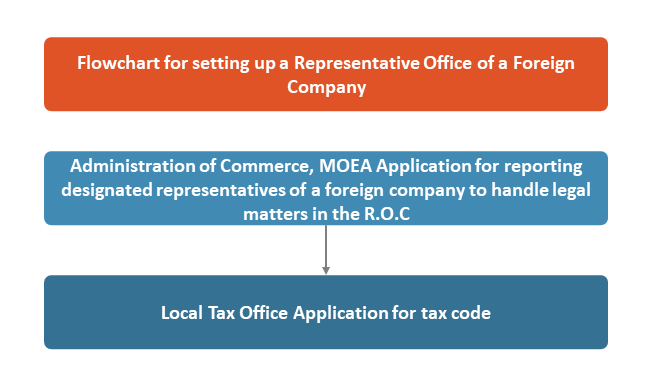

- Setting up a representative office of a foreign company

- Example

Representative Office/Branch/Subsidiary

Payroll Outsourcing Services

We operate clients’ payroll from data collection, preparation and source-to-gross calculation right up to statutory reporting, payment preparation and employee communication.

- Establishing and managing your company’s preferred payment process

- Effecting applicable employee social security reductions

- Managing end-of-year withholding tax statements and declarations

Global Mobility and Expatriate Income Tax Services

Our professionals help clients address key tax, immigration and compensation challenges of managing a globally mobile workforce by streamlining mobility programs, ensuring compliance, and enhancing employee experience.

Our services include:

- Taiwan employment gold card application

Launched in 2018, the Taiwan Employment Gold Card is a 4-in-1 card, that includes a resident visa, work permit, Alien Resident Certificate (ARC), and re-entry permit, which allows foreign nationals to leave and re-enter Taiwan multiple times over the course of 1-3 years. We help foreign nationals to determine qualification, prepare and submit the Taiwan employment gold card application.

- Taiwan visa and work permit applications

Employers must get a Taiwan work permit for a foreign employee they plan to hire. Both employer and employee need to meet the application qualification prescribed by Taiwan authority. We help our clients determine qualification, prepare and submit the work permit and relevant visa applications.

- Permanent resident and citizenship applications

- Consular services and cross-border support

- Document legalization services

- Individual income tax return preparation

Individuals in Taiwan are subject to Taiwan consolidated income tax. However, the amount of income subject to tax and the applicable rates depend on the length of stay as well as on the individual’s residence status. We help our clients determine filing status, prepare and file the Taiwan individual income tax return.

Other Tax Services

- Corporate income tax service

- Withholding tax obligations

| Representative Office | Branch | Subsidiary

(share/limited) |

|

| Legal Representative in Taiwan | Require an agent for litigious & non-litigious matters, can be Taiwan citizen or foreigner. (but require to have Taiwan resident address) | Require for branch manager and an agent for litigious & non-litigious matters. Both need not be Taiwan citizen, but the foreigner requires having Taiwan residency address. | Require a director to be in-charge of all legal activities in Taiwan. |

| Capital Requirement | Not required | No minimum requirements, but the capital still needs to be examined and certified by a local CPA and covers at least the incorporation cost. (Note 1) | No minimum requirements, but the capital still needs to be examined and certified by a local CPA and covers at least the incorporation cost. (Note 1) |

| Sales Transaction | Prohibited | Allowed, all the earnings are accountable for Taiwan Income Tax and relevant tax. | Allowed, all the earnings are accountable for Taiwan Income Tax and relevant tax. |

| Sales Activities | All sales transactions are to be processed outside of Taiwan. | Sales are to be invoiced in Taiwan. All the revenue will be subject to local tax rate. | Sales are to be invoiced in Taiwan. All the revenue will

be subject to local tax rate. |

| Taxation | N/A | 20% company income tax and other local tax rate. | 20% company income tax and other local tax rate. |

| Tax Incentives | N/A | N/A | It depends on type of

the business operating. |

| Local Accounting Requirement | N/A | Required for VAT reporting & yearly Company Income Tax declaration. | Required for VAT reporting & yearly Company Income Tax declaration. |

| Expatriate recruitment | Allowed only the representative | Allowed, the Branch’s operating capital would need to be at least NT$5,000,000. | Allowed, the Company’s Paid-In capital need to be at least NT$5,000,000. |

| Example | Wal-Mart | ING (Life Insurance of America) | IBM, Philip, HP |

*Note 1. If the business entity engages in activities that require a special permit or approval, the authorities may set a higher capital requirement

*Rate based on 2023 Tax Rate Issued